註 冊 歐 美 本 土 公 司,

歐 美 本 土 稅 務 政 策,

出 海 歐 美 – 全 球 市 場!

Register UK LOCAL COMPANY in Europe and the United States,

European and American LOCAL TAX POLICY,

EXPORT – UK-Europe and USA-the United States – GLOBAL MARKET!

Our NEW YORK LEGAL TEAM MEMBERS

低成本,低税收,销售范畴巨大;

销售市场横穿欧盟27成员国!

免验资 – 全注册过程(免签)

Low cost, low tax, huge sales scope;

The sales market spans 27 EU member states!

No capital verification – full registration process (no visa required)

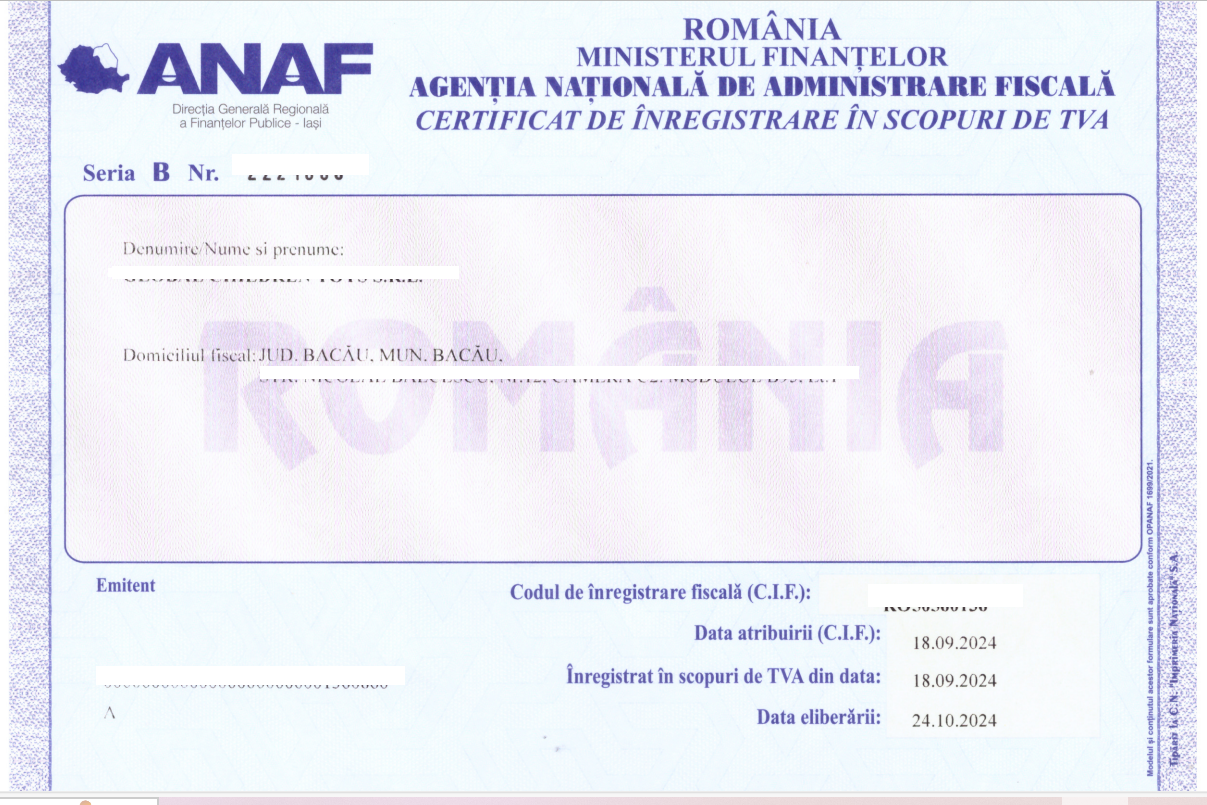

歐洲站,中國電商賣家註冊『羅馬尼亞公司』

European station, Chinese e-commerce seller registers “Romanian company”

註冊【羅馬尼亞公司】,閣下將受益於:

Register a [Romanian company], you will benefit from:

- 免驗資;

- 註冊流程,免簽;

- 注冊週期:5–6周內;

- No Capital Verification required;

- Registration Process, Visa-free;

- Registration Period: within 5–6 weeks;

申請開立當地實體銀行戶口(如需),免簽;

- 對中國人友好,稅收低;

- 註冊一國可銷售歐盟27成員國;(適用於普遍95%的基本商品流通)

- Apply to open a local physical Bank Account (if necessary), Visa-free;

- Friendly to the Chinese and Low Taxes;

- Registration in one country can sell to 27 EU member states; (applicable to 95% of basic commodity circulation)

- 注冊位址一年的使用(無國界,可收取商務及官方信件);

- 注銷公司的時常(時效40-60天);*須在稅務問題賬目清楚的情況下注銷。

- Use of the registered address for one year (no borders, business and official letters can be received);

- Time limit for canceling a company (40-60 days);

*Cancellation must be done when the tax issues and accounts are clear.

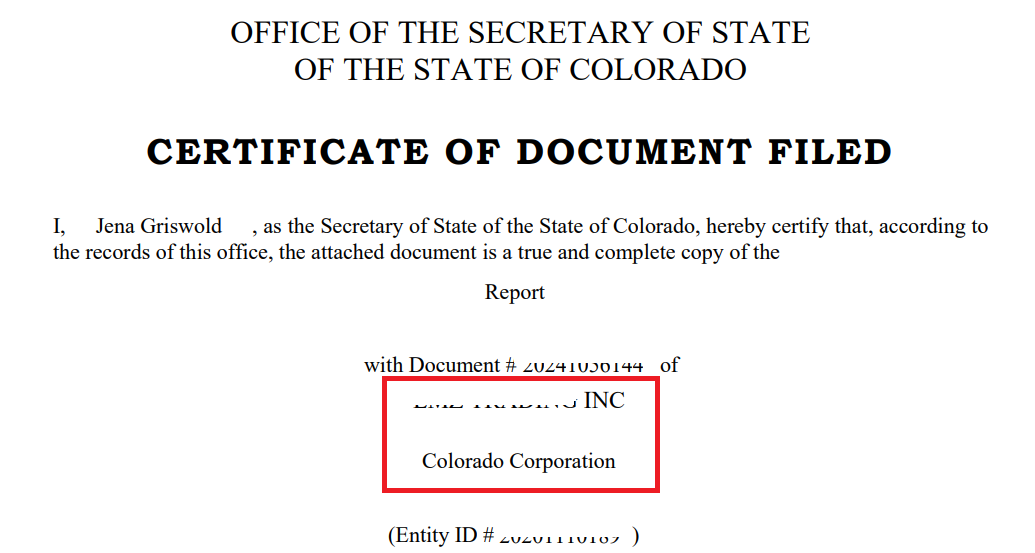

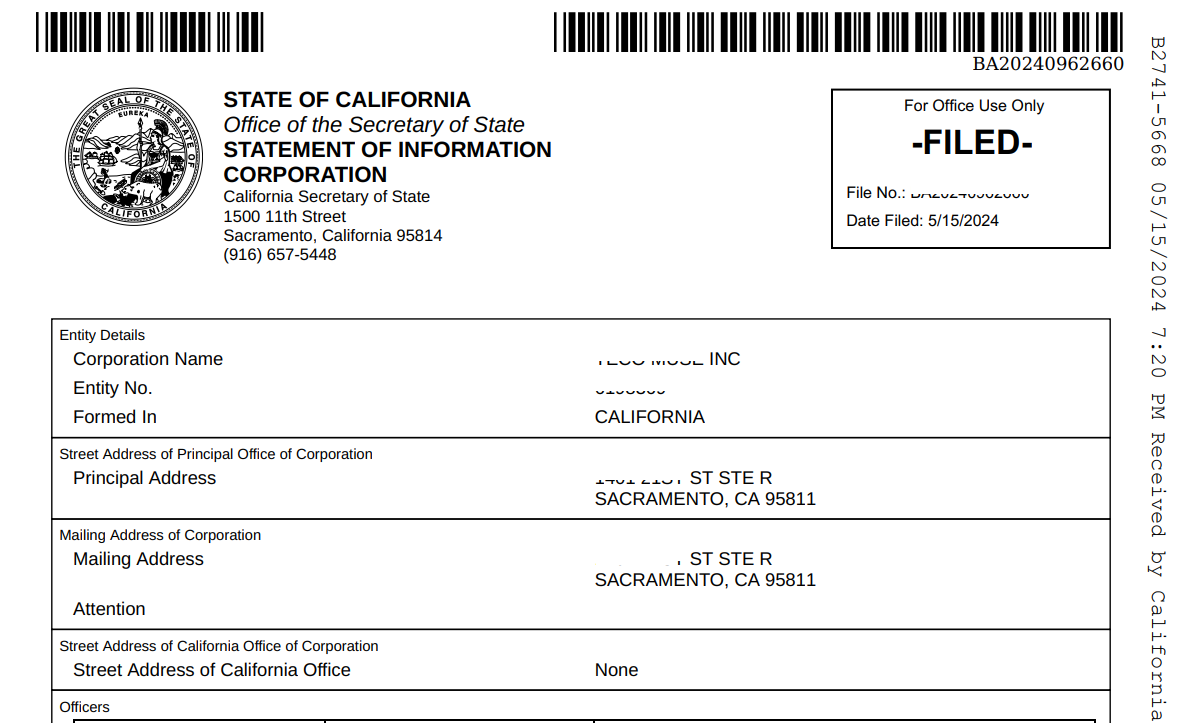

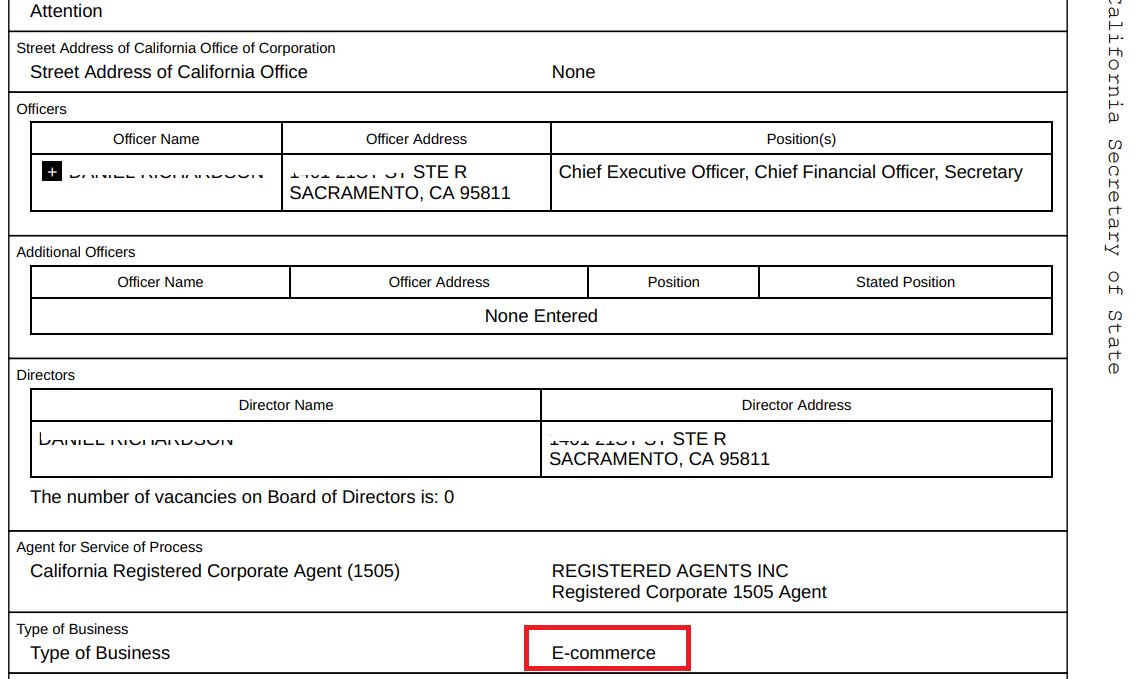

美國站 – 中國電商賣家出海USA-北美

AMERICAN COMPANY – Chinese Amazon e-Commerce Seller/All Foreigners to Register US COMPANY

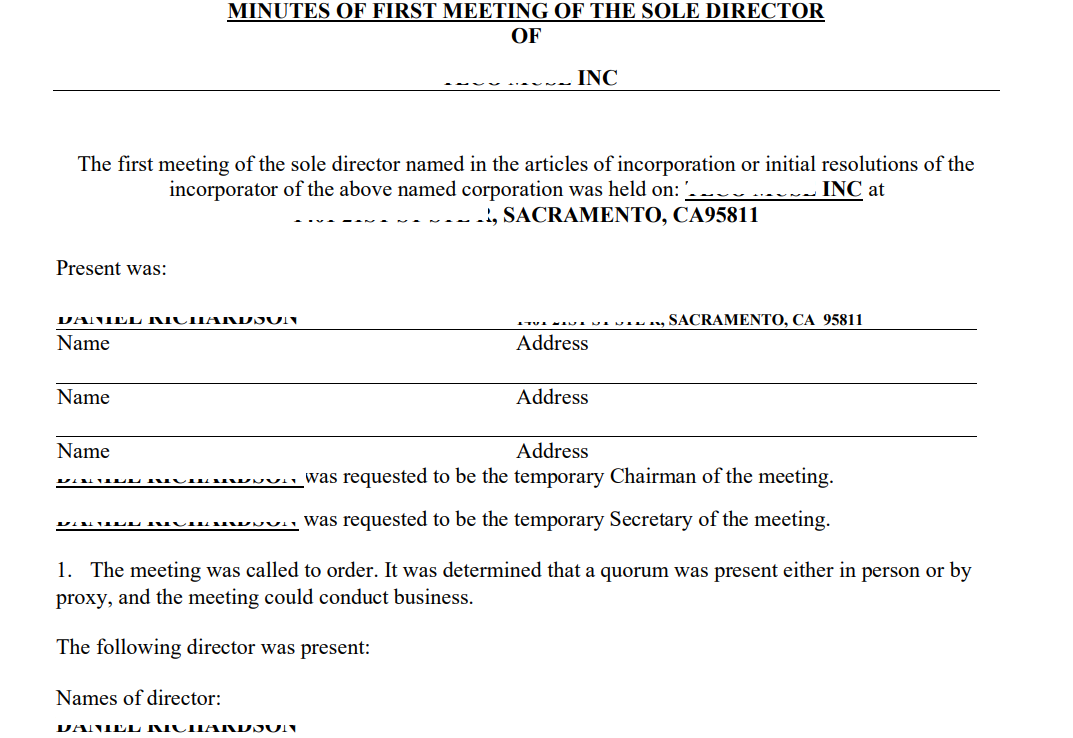

中國身份註冊美國公司:

不需要面簽,不需要視頻,不需要銀行流水,

不需要法人近照 (*如有變化,則以當下政策為準)

Advantages of choosing us [Chinese Citizens registered USA LOCAL COMPANY*]:

No face-to-face interview, No Video, No Bank Statement required.

A recent photo of the Legal Person is not required (*If there is any change, the current policy shall prevail)

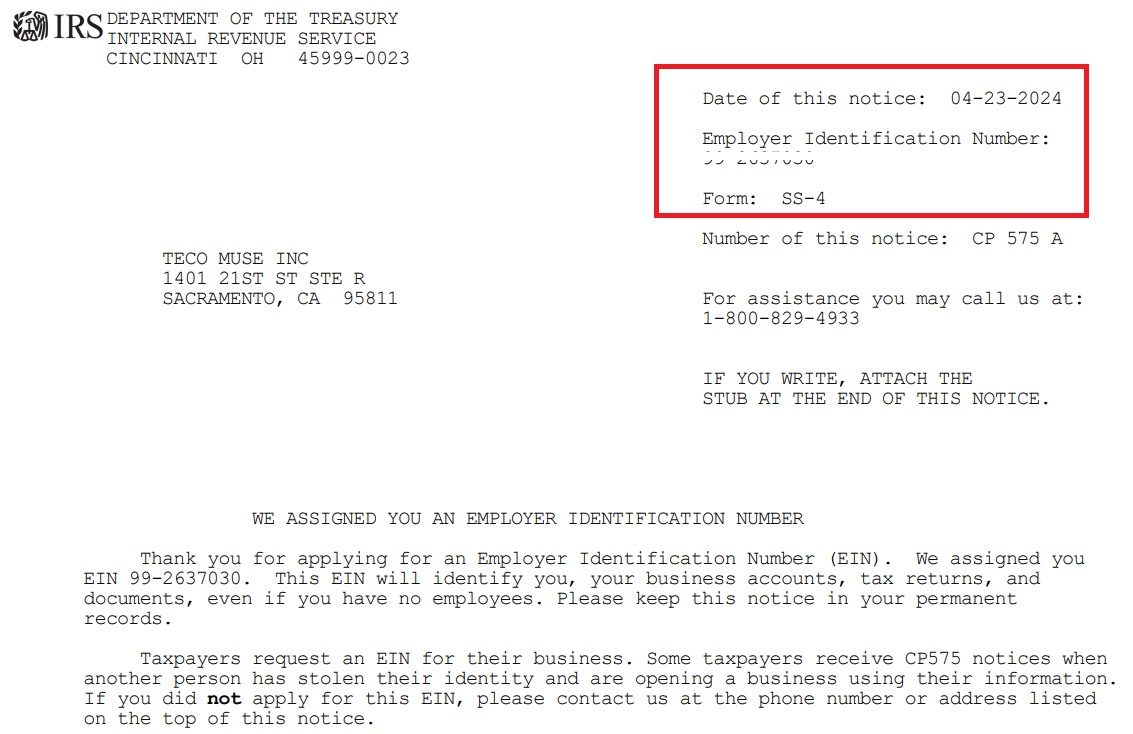

中國公民可註冊的美國公司常見註冊類型有:

股份有限公司(C型)及 有限責任公司(LLC型)

一般選擇:股份有限公司(INC型)

Common registration types of U.S.A LOCAL COMPANY that Chinese Citizens (*All Foreigners) can registering are:

Joint Stock Company (C type) and Limited Liability Company (LLC type)

General choice: Limited Company (INC type)

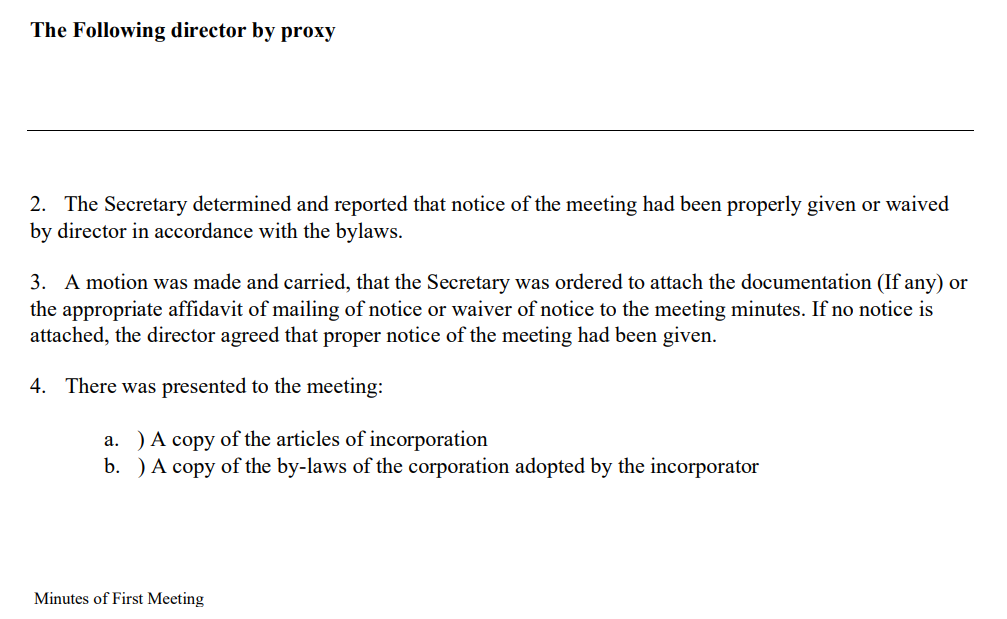

股份有限公司(INC COMPANY)

- C-Corporation股份有限公司(C 型公司簡稱INC)是一個獨立的法律實體,由股東擁有。這類公司承擔自身債務和責任,其利潤與股東個人收入分開徵稅。INC公司則要求在公司和股東個人所得兩個方面繳納稅款,理解為為雙重徵稅。

A C-Corporation, Inc. (INC for short) is an independent legal entity owned by shareholders. Such companies bear their own debts and liabilities, and their profits are taxed separately from the shareholders’ personal income. INC Companies are required to pay taxes on both corporate and shareholder personal income, which is understood to be double taxation.

- Limited Liability Company (LLC 型公司)也是一個獨立法人實體,為其所有者(稱為成員)提供有限責任保護。LLC公司結合了公司的有限責任保護和合夥企業的管理及稅務靈活。

- A Limited Liability Company (LLC) is also a separate legal entity that provides limited liability protection to its owners, called members. An LLC combines the limited liability protection of a corporation with the administrative and tax flexibility of a partnership.

- 如股東無美國身份,無美國SSN社安號,公司無收入的情況下則按照C-Corp公司稅務類型申報公司所得稅比較簡單。

- If the shareholder does not have U.S. identity, does not have a U.S. SSN, and the company has no income, it is relatively simple to declare corporate income tax according to the C-Corp company tax type.

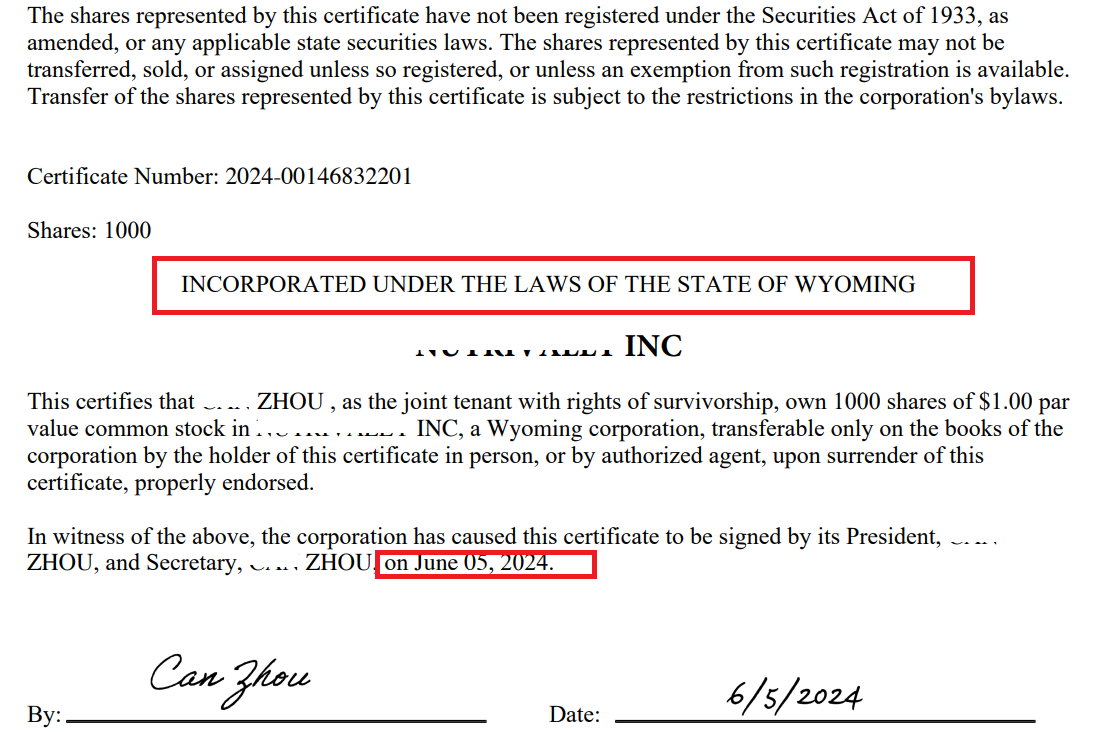

選擇哪個州註冊美國公司

Choose which state to register a U.S. company

| 選擇哪個州? 美國的各個州的法律法規都不一樣 |

一般可選擇5洲註冊:

|

| Which State to choose? Each State in the United States has different laws and regulations |

Generally, you can choose to register THE US COMPANY in 5 states:

|